How to Calculate Customer Lifetime Value (CLV)

This might come as a surprise, but a majority of your customers make up only a small percentage of your company’s profit. That majority is also more likely to purchase elsewhere if something better or less expensive comes along. That being said, building your marketing strategy to attract more of these "Meh" customers doesn't make business sense. These customers have a high attrition rate and will not equal long term profit. In fact, keeping them around is often more expensive than it is worth. This article will help you identify your most valuable customers, so that you can focus on bringing in more of them and maximize return on your marketing investment.

This might come as a surprise, but a majority of your customers make up only a small percentage of your company’s profit. That majority is also more likely to purchase elsewhere if something better or less expensive comes along. That being said, building your marketing strategy to attract more of these "Meh" customers doesn't make business sense. These customers have a high attrition rate and will not equal long term profit. In fact, keeping them around is often more expensive than it is worth. This article will help you identify your most valuable customers, so that you can focus on bringing in more of them and maximize return on your marketing investment.

How Much is a Customer Worth?

The answer could depend on how much “coffee” they drink. Can you guess how much an average customer is worth to Starbucks? Think about all the coffee you are going to buy from Starbucks over the years. $500 worth? $1,000? $2,000? How about $14,000?? That's right! Starbucks calculated that the average lifetime value of their customer is $14,099.  Knowing this number for your company can drastically change how you look at your marketing. Starbucks marketers know that they aren’t selling a $5 cup of coffee; they are acquiring a $14k customer.

Knowing this number for your company can drastically change how you look at your marketing. Starbucks marketers know that they aren’t selling a $5 cup of coffee; they are acquiring a $14k customer.

Most of Your Customers Aren't That Valuable

The Pareto Principle (also known as the 80-20 rule) states that roughly 80% of the effects come from 20% of the causes. When applied to your customers, the rule of thumb is that 80% of your sales come from 20% of your customers. In other words, your “All-Star” customers are worth a lot more than your "Meh" customers.  Applying the same principle to our previous example means that 20% of Starbucks customers, who most likely drink coffee every day, are worth a lot more to Starbucks compared to the 80% who only stop by for an occasional cup.

Applying the same principle to our previous example means that 20% of Starbucks customers, who most likely drink coffee every day, are worth a lot more to Starbucks compared to the 80% who only stop by for an occasional cup.

Not Knowing Your High Value Customers is Going to Cost You

Research done by Dr. Peter Fader, a Wharton marketing professor, shows that as many as 66% of marketing professionals don’t know how much their customers are actually worth and consequently miss the opportunity to increase their sales by as much as 17%. If they were to identify and target their high value customers, it would be a different story.

It goes without saying, you don’t want to waste time, money or marketing mojo attracting customers that will not be profitable. You want to know how much you should invest into marketing that will attract "good customers". At what point and with what customers do you break even and become profitable? If you tailor your marketing to attract more High Value Customers, every marketing dollar you invest will return that value many times over.

Who Are Your High Value Customers?

What does a 'Best Customer' mean to you? Different people will give different answers: Customers who are the most profitable. Customers who are the most loyal. Customers who are the easiest to attract and retain… How about all of the above? Here at Intechnic, we call these customers HVC or High Value Customers, or customers with the Highest Customer Lifetime Value (CLV or CLTV). It is also sometimes referred to as Lifetime Customer Value (LCV), or Life-Time Value (LTV). To identify your High Value Customers (HVC), first you want to calculate the Customer Lifetime Value (CLV) of each customer and then rank them by the results. The higher the CLV, the more valuable the customer. Our Customer Lifetime Value Excel Spreadsheet makes it easy to calculate and compare your customers' value.

What is Customer Lifetime Value (CLV)?

Customer Lifetime Value (CLV) is the total profit you can expect to earn from a customer throughout your entire business relationship with them. Many companies look at this number to determine how much a customer is worth to them.

How Do You Calculate Customer Lifetime Value (CLV)?

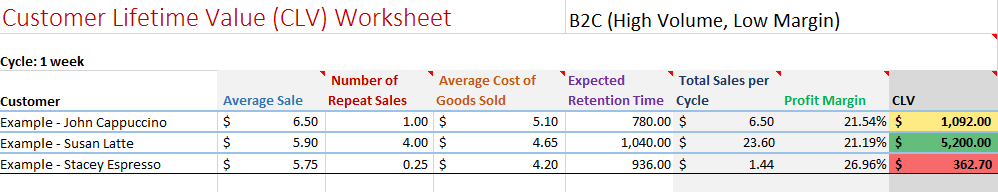

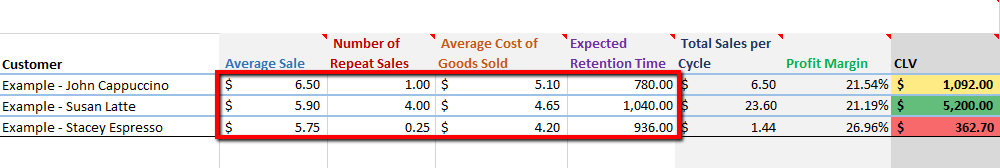

There are many ways to calculate Customer Lifetime Value (CLV or CLTV) but, to help you with the heavy-lifting, we created a CLV Excel template & examples spreadsheet that you can use to plug in as few numbers as possible. It contains the following two examples:

- B2C (High Volume, Low Margin) for a business selling coffee

- B2B (Low Volume, High Margin) for a business selling marketing automation software

The calculation and terminology will differ slightly depending on which business you are in but the fundamentals remain the same. Our Customer Lifetime Value Excel Spreadsheet will guide you through the tougher formulas. Look for hints in the spreadsheet or refer to the legend below. If you paid attention in college and want to study the formulas more closely, we have shared them here.

What is the Customer Lifetime Value (CLV) Formula?

There are at least half-a-dozen Customer Lifetime Value (CLV) formulas (simple CVL formula, custom CVL formula, traditional CVL formula, etc.). The one we use (custom) is as follows: CLV = Average Sale x Number of Repeat Sales x Expected Retention Time x Profit Margin  CLV Example: $5.90 x 4 times x 20 years x 21.19% = $5,200 You may also need to use the following two formulas: Formula to calculate Average Sale per Cycle: Average Sale = Total Sales / Number of Repeat Sales Example: Susan spends on average $5.90 per transaction: $23.60 per week / 4 times per week Formula to calculate Profit Margin: Profit Margin = (Average Sale – Average Cost of Sale) / Average Sale x 100 Example: Profit margin for Susan is 21.19% = (($5.90 - $4.65) / $5.90) x 100

CLV Example: $5.90 x 4 times x 20 years x 21.19% = $5,200 You may also need to use the following two formulas: Formula to calculate Average Sale per Cycle: Average Sale = Total Sales / Number of Repeat Sales Example: Susan spends on average $5.90 per transaction: $23.60 per week / 4 times per week Formula to calculate Profit Margin: Profit Margin = (Average Sale – Average Cost of Sale) / Average Sale x 100 Example: Profit margin for Susan is 21.19% = (($5.90 - $4.65) / $5.90) x 100

Don't You Wish You Paid Attention in Finance Class?

It's not all that bad… Let's break it down more and look at all the components:

- Cycle – The time increment that you use in your business calculations (week, month or year). It doesn't matter what your cycle is, just make sure you use the same cycle for all customers and calculations. Example: Company measures coffee purchases in 1 week increments; Cycle = 1 week

- Total Sales – Total Revenue per cycle received from each customer (sales per cycle). Example: Susan spends $23.60 per week on coffee ($5.90 per transaction x 4 times a week); Total Sales = $23.60

- Number of Repeat Sales – Number of times a customer bought from you during the cycle (Sales per Cycle). Example: Susan buys coffee 4 times per week; Number of Repeat Sales = 4

- Average Cost of Sale – Your cost of providing goods or services. Make sure to include your cost of customer acquisition (the amount it cost you to acquire this customer) as well as the cost of servicing this customer. Example: Each coffee Susan buys at $5.90 costs the company $4.65 (including cost of supplies, labor and marketing); Average Cost of Sale = $4.65

- Expected Retention Time – Amount of time (measured in purchasing cycles) you expect to retain the customer. Note: Make sure to use the same cycle (weeks, months, years) for all customers. Example: Susan is expected to remain a customer for 1,040 weeks = 20 years x 52 weeks (if you use weeks as cycles); Expected Retention Time = 1,040 weeks

- Average Sale – Average revenue received from the customer per transaction during the cycle (total customer revenue divided by the number of purchases in the cycle). Example: Susan spends an average of $5.90 per transaction ($23.60 per week / 4 times per week); Average Sale = $5.90

- Profit Margin – Profit Margin (%) per customer: ((Average Sale - Average Cost of Sale) / Average Sale) x 100 Example: Profit margin for Susan is 21.19% = (($5.90 - $4.65) / $5.90) x 100

Plug these numbers into the CLV Excel spreadsheet (color coded to the legend) to calculate CLV for each customer.

Plug these numbers into the CLV Excel spreadsheet (color coded to the legend) to calculate CLV for each customer.

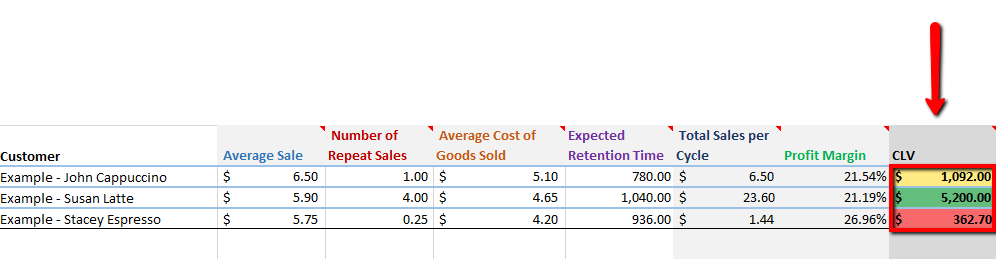

Segment Out Your HVCs from the Rest

Once you calculate CLV for each customer, you will have clear view of how valuable they are in relation to one another. The higher the CLV, the more valuable the customer. Repeat this process for each customer and compare them using the Customer Lifetime Value Excel Spreadsheet.  By breaking your customers into meaningful groups, you can obtain vital data about what type of customers you really want to attract: HVCs. The worksheet automatically groups customers for you so that you can, upon calculation, see them in 3 "colored" silos:

By breaking your customers into meaningful groups, you can obtain vital data about what type of customers you really want to attract: HVCs. The worksheet automatically groups customers for you so that you can, upon calculation, see them in 3 "colored" silos:

|

High Value Customers |

Good Customers |

"Meh" Customers |

|

Most profitable, most loyal customers with a small attrition rate, low acquisition cost and a very high lifetime value. These are the customers you want. |

Customers who stick around for a while, are somewhat profitable and have a decent lifetime value. These are the customers that you want to eventually convert into HVCs. |

Keeping these customers around is often more expensive than it is worth. They have a high attrition rate and are not profitable. |

Download our CLV Excel spreadsheet to help identify your High Value Customers:

Next Steps: Interview Your HVCs

Remember, you want to bring in more HVCs to maximize the return on your marketing investment. Once you have identified your best customers, it’s time to start gathering more information and figuring out what characteristics your best customers possess. In order for you to target HVCs, you need to understand them better: what makes an HVC an HVC? How do they make purchasing decisions? Are there patterns in their purchasing behavior? What are some of the common traits that define an HVC? The best way to collect this information is to interview your customers. This will be the focus of our next article: Website User Interviews - How to Interview Customers for Marketing Goals.